This provides a true reflection of the asset’s value and helps in presenting a more accurate financial position of the company. It is is an essential component of financial accounting, allowing businesses to allocate the cost of an asset over its useful life. One method of determining depreciation involves considering the asset’s salvage value. The salvage value after tax salvage value formula is the estimated residual value of the asset at the end of its useful life. Salvage value, also known as residual value or scrap value, is a fundamental concept in accounting and asset management.

How to Calculate After-Tax Real Interest Rate

This is because governments in most of the countries collect tax from companies, which is based on the profits they generate. And the depreciation rate on which they will depreciate the asset would be 20%. Salvage value is a commonly used, if not often discussed, method of determining the value of an item or a company as a whole. Investors use salvage value to determine the fair price of an object, while business owners and tax preparers use it to deduct from their yearly tax liabilities. You can stop depreciating an asset once you have fully recovered its cost or when you retire it from service, whichever happens first.

What Is MACRS Depreciation?

This is the most the company can claim as depreciation for tax and sale purposes. If your business owns any equipment, vehicles, tools, hardware, buildings, or machinery—those are all depreciable assets that sell for salvage value to recover cost and save money on taxes. The balance sheet shows the net book value of an asset, which is the original cost minus accumulated depreciation, helping stakeholders understand the asset’s current worth.

Salvage Value vs. Depreciation

- Many companies use a salvage value of $0 because they believe that an asset’s utilization has fully matched its expense recognition with revenues over its useful life.

- Salvage value is the monetary value obtained for a fixed or long-term asset at the end of its useful life, minus depreciation.

- Simply put, when we deduct the depreciation of the machinery from its original cost, we get the salvage value.

- The straight-line depreciation method is one of the simplest ways to calculate how much an asset’s value decreases over time.

- The carrying value of an asset as it is being depreciated is its historical cost minus accumulated depreciation to date.

The salvage value is important for accounting purposes as it allows for the calculation of depreciation expense. When calculating depreciation in your balance sheet, an asset’s salvage value is subtracted from its initial cost to determine total depreciation over the asset’s useful life. Companies determine the estimated after tax salvage value for anything valuable they plan to write off as losing value (depreciation) over time. Each company has its way of guessing how much something will be worth in the end. Some companies might say an item is worth nothing (zero dollars) after it’s all worn out because they don’t think they can get much.

Sometimes, the thing might be sold as is, but other times, it might be taken apart and the pieces sold. So, salvage value is the money a company expects to make when they get rid of something, even if it doesn’t include all the selling or throwing away costs. In the example, the machine costs $5,000, has a salvage value of $1,000, and a 5-year life. With a 20% depreciation rate, the first-year expense is $800, and the second year is $640, and so on. So, when a company figures out how much something will lose value over time (depreciation), they also think about what it might still be worth at the end, and that’s the salvage value of that asset. You don’t claim any tax deductions or credits for the furniture, so your basis for depreciation is $8,000.

- Other times, it’s about figuring out how much it’s worth when it’s done for good, minus the cost of getting rid of it.

- Tax code requires the company to depreciate the plant over 5 years with $10 million salvage value.

- Net present value (NPV) is a technique used in capital budgeting to find out whether a project will add value or not.

- This valuation is determined by many factors, including the asset’s age, condition, rarity, obsolescence, wear and tear, and market demand.

- You also paid an additional $50,000 for legal fees, mortgage recording costs, and other acquisition-related expenses.

- The applicable tax rate on the gain from the asset sale significantly impacts the after-tax salvage value.

The method may involve a lot of effort and time and also may require access to information and data on the ongoing market conditions. After following this guide, you have now completed your first calculation with this method. It’s important to note that this method assumes a linear depreciation pattern and may not accurately capture potential asset value variations. An asset’s salvage value subtracted from its basis (initial) cost determines the amount to be depreciated. Most businesses utilize the IRS’s Accelerated Cost Recovery System (ACRS) or Modified Accelerated Cost Recovery System (MACRS) methods for this process.

- It uses the straight-line percentage on the remaining value of the asset, which results in a larger depreciation expense in the earlier years.

- In some contexts, residual value refers to the estimated value of the asset at the end of the lease or loan term, which is used to determine the final payment or buyout price.

- The property doesn’t qualify for ADS treatment, so the proper MACRS system is the GDS.

- If the assets have a useful life of seven years, the company would depreciate the assets by $30,000 each year.

- It’s the estimated value of something, like a machine or a vehicle, when it’s all worn out and ready to be sold.

- The condition of the asset is an essential factor in determining its salvage value.

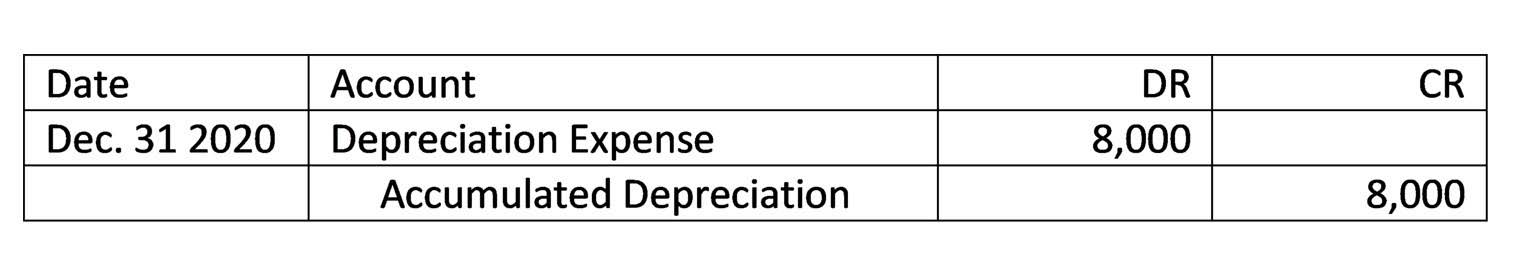

It is a method of recognizing the decline in value and the wear and tear of an asset over time. Depreciation expense is Accounting Periods and Methods reported on the income statement and reduces the value of the asset on the balance sheet. Salvage value is also called scrap value and gives us the annual depreciation expense of a specific asset. It must be noted that the cost of the asset is recorded on the company’s balance sheet whereas the depreciation amount is recorded in the income statement.

Is Salvage Value the Same as Selling Price?

You might have noticed that some property can be depreciated using more than one method. That’s because you can elect to use a different method for certain types of property. It is expected to stay economical for 5 years after which the company expects to upgrade to a more efficient technology and sell it for $30 million.

Commenti recenti